Describe the Uses of Residual Income Models

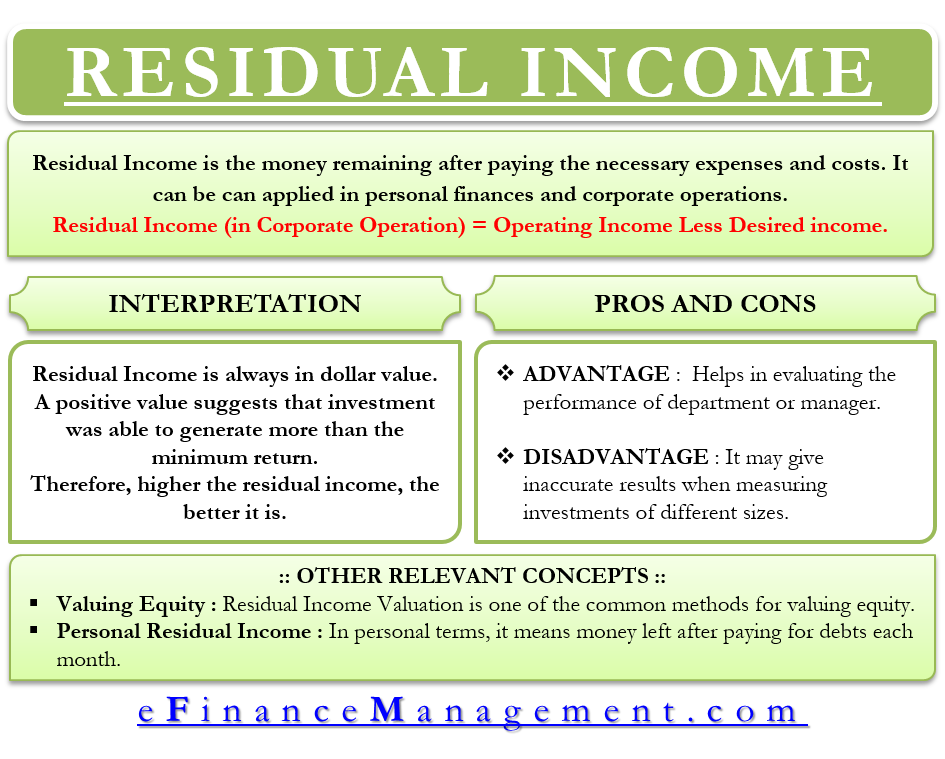

Residual income is typically used to assess the performance of a capital investment team department or business unit. Calculate and interpret residual income economic value added and market value added describe the uses of residual income models calculate the intrinsic value of a common stock using the residual income model and compare value recognition in residual income and other present value models explain fundamental determinants of residual income.

Residual Income Formula All You Need To Know

Open a subscription business 3.

. RI models use readily available accounting data. The residual income valuation formula is very similar to a. Passive income includes things like royalties received for creating an intellectual property such as a book advertisement payments received for Internet traffic on websites or content you create dividends paid on stocks you hold and rent payments.

We have discussed the use of residual income models in valuation. One of the primary benefits of residual income is that it takes little continued effort to maintain. The residual income is used in corporate finance to measure corporate performance.

The calculation of residual income is as follows. Residual Income Model is an equity valuation method used to estimate the true or intrinsic value of a stock based on the present value of all future residual income the company generates. 3 Types of Residual Income Corporate finance Personal finance Online business 4 How to Make Residual Income 1.

Strengths of the residual income model include. This minimum requirement is usually equal to the cost of the investment. It allows a companys management to evaluate the income after all capital costs have been paid.

Build an Instagram following. Calculate and interpret residual income economic value added and market value added. Calculate the intrinsic value of a common stock using the residual income model and compare value recognition in residual income and other present value models.

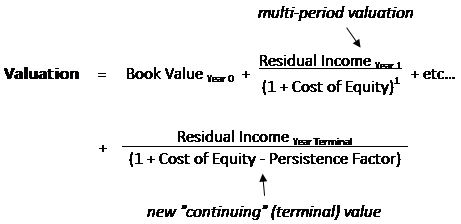

In this theory every stock is worth the companys book value per share if investors expect the company to earn a normal rate of return in the future. The General Residual Income Model An important assumption behind the residual income model is clean surplus relation which states the relationship among earnings dividends and book value per share. Residual Income Model There are a variety of differing methods when using the residual income formula in the approach to valuing a company or its company stock.

Start a dropshipping store 2. Also called the abnormal earnings valuation model the residual income model is a method for predicting stock prices. The study by Penman 1997 contrasts dividend discounting models discounted cash flow models and residual income models on the basis of accrual accounting.

When theres a positive RI it means the company exceeded its minimal rate of return. It is among several financial metrics used to assess internal corporate performance. Residual income RI also known as economic profit is income earned beyond the minimum rate of return.

For example you could set up a landing page to sell an e-book or online course. Describe the uses of residual income models. Residual Income Monthly Net Income - Monthly Debts This calculation takes into account a persons take-home pay and subtracts.

The study also showed that some models which are apparently different yielded the same valuation. It can be used as a way to approve or reject a capital investment or to estimate the value of a business. The residual income approach is the measurement of the net income that an investment earns above the threshold established by the minimum rate of return assigned to the investment.

2775 0 0 September 10 2019. Publish a book 7. It means that actual or potential return exceed the minimum return required.

Residual income is calculated as net income minus a deduction for the cost of equity capital. BV 1 BV 0 EPS 1 - D 1 This means all changes in book value can be explained by the companys accounting profits and distributions to shareholders. On the contrary a negative RI means it failed to meet the projected rate of return.

There is the discounted cash flow model or one may select the dividend discount method. It can be used to value companies with no positive expected near-term free cash flows. Residual income is the income a company generates after accounting for the cost of capital.

Residual income is common concept used in valuation and can be defined as the excess return generated over the minimum rate of return often referred to as the cost of capital of the amount of net income. Create an app 6. Residual Income Formula Net Income of the Firm Equity Charge.

It can be used to value non-dividend paying companies. Generally an investment is acceptable if the residual income is positive. The model gives less weight to terminal value.

Rent out your property 4. Crowdfund real estate 5. Residual income is calculated as operating income minus desired income or minimum income required.

In this scenario the residual income is calculated by this formula. A company has two sources of capital equity and debt. Sell digital products on Etsy 9.

How Does a Residual Income Model Work. These assets pay you a monthly amount thats higher than the cost of holding or maintain the asset itself. Personal finance can also define residual income as income that is not earned after completing all work or after all debts and obligations have been paid.

The cost of debt represented by interest expense is deducted from. Example of the Residual Income Approach. Residual Income in Corporate Finance Calculating the residual income enables companies to allocate resources among investments in a more efficient manner.

Residual income is an appealing economic concept because it attempts to measure economic profit which are profits after accounting for all opportunity costs of capital. Essentially you earn residual income from income-generating assets. Passive income comes through very little work on your part.

The not-so-common method for valuing a company is the residual income model. 3 describe how following Johnson and Kaplans. The residual income valuation model b.

It can be used when cash flows are unpredictable. Residual income measures net income after all capital costs necessary to make that income have been considered.

Residual Income Valuation Ppt Video Online Download

Residual Income Valuation Method Cfa Level 2

Residual Income Valuation Ppt Video Online Download

Using Residual Income Ri To Evaluate Performance Accounting For Managers

No comments for "Describe the Uses of Residual Income Models"

Post a Comment